We Need Transparency in Infrastructure Project Development

During the initiation phase projects are defined and then assessed for viability. This involves identifying the problem the project is trying to solve (strategic objectives), identifying the potential solutions to achieve those objectives, determining the preferred solution, identifying the benefits that solution will deliver, estimating the cost to build the solution and determining whether the benefits are greater than the investment costs.

Optimism Bias and Vested Interests

The prevalence of optimism bias during this phase is a key issue and leads to an over-estimation of benefits and an under-estimation of costs and risks. This leads to a project cost-benefit ratio that is out-of-step with reality. Erroneous decisions are made through rose-tinted glasses, and unfortunately in the case of mega-projects this costs the public significant amount of money.

To add to this issue there are many parties involved in the project lifecycle that have vested interests in infrastructure projects moving ahead these include Public Servants employed by delivery agencies, consultants, contractors, and other special interest groups set to benefit for the project. Having a vested interest these parties are more inclined to experience optimism bias and thus understate risks and overstate benefits so that these projects proceed.

Unfortunately, once a project has moved deep into the planning phase it is highly unlikely that it will be shelved due to cost blow-outs and delays. This is because the sunk cost fallacy makes the political ramifications of leaving a major project unfinished significant.

Opaque Decision Making by Government Agencies

Government agencies are seemingly aware of these issues and have taken steps to withhold the information available to the public to review and thus prevent criticism of project investment decisions. With financial information often redacted from publicly available final business case documents. Given it is public funds being spent and committed to these projects, this practice would appear to out of step with the expectations of voters.

The unfortunate consequence of all of this is that potentially uneconomical mega projects are proceeding based on the incorrect information. To make matters worse when the inevitable and significant cost blow-outs occur the government of the day needs to scrap other worthy projects to cover the short fall. The community loses out on when this happens, and it is really about time that governments take the issue of mega project cost blow-outs seriously.

Case Study – Sydney Metro

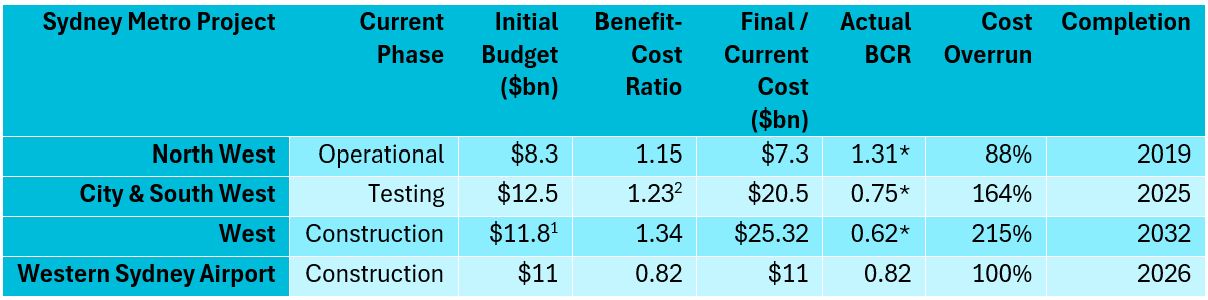

The ongoing Sydney Metro projects serve as a case study of these issues. This initiative includes four mega-projects, each with varying degrees of success. The North West project was delivered on time and under budget, while the City & South West and West projects are both significantly over budget and delayed.

1 – Sydney Metro West Initial budget not provided by NSW Government. Inferred from BCR and Net Present Value of Project Benefits

2 – Sydney Metro City and South West BCR not provided in the publicly available business case. Calculated based on the Net Present Value of the Project Benefits and the Initial Budget.

*Actual BCRs calculated by multiplying the BCR by the initial budget and dividing by the final/current cost.

Insights we can gain from the data are as follows:

- The North West project was a success based on the publicly available numbers delivered on-time and under budget.

- By contrast the City & South West and West projects are both significantly over budget and both are ~20% delayed from the original completion date. Concerningly the Sydney Metro West project still has 8 years to go, leaving plenty of opportunity for things to go wrong.

- Interestingly the Western Sydney Airport line started out as an uneconomical project from a benefit-to-cost ratio perspective. With Infrastructure NSW noting that the project was still a sound investment decision “being a long-term city-shaping initiative with benefits taking a long lead time to become manifest following the opening of Western Sydney International and the Western Sydney Aerotropolis.”

The questions that arise from these projects include why the estimates for the City & South West and West projects were so inaccurate, why projects with a benefit-to-cost ratio below 1.0 are being approved, why the government is withholding cost and financial information, and what impacts this will have on future generations.

While the answer to these questions are no doubt complex, the public has a right to full transparency and involvement in these decisions.

These same issues are occurring right across the country with the Snowy Hydro 2.0, ARTC’s Inland Rail and Melbourne’s Suburban Rail Loop just some examples of mega projects experiencing mega cost blow-outs.

What Can Be Done to Fix This Moving Forward?

The problems faced by the programs are complex, and likely the final cost would not be significantly reduced by better planning. The real improvements can be gained by being more open, trusting the public, improving governance over decision making and using data from comparable projects to get more accurate estimates. All this happens before any commitment to deliver the project.

- Transparency – For a start well project definition phase and the investment decisions that come from it need to be much more transparent. Governments and their agencies need to cognisant that they are spending public money.

- Robust Framework for Determining Value for Money – Logically a project that has a Benefit-to-Cost ratio (BCR) of less than 1.0 should not be approved as currently envisaged. Noting that projects typically exceed budget by some margin and under deliver on proposed benefits perhaps the required minimum BCR should be 1.5. If a project comes in for approval below this value it should be sent back to the planners for review of the scope and proposed benefits. This may require significant changes to the proposal to increase the benefits or decrease the costs.

- Get Better at Pricing Intangible Benefits – If important benefits such as energy security, sovereignty, city-shaping, or nation-building, always make uneconomical projects worth of investment then there would seem to be no point even doing an appraisal of the project. Clearly there is a cost level above which a project is unviable even with these significant benefits. So, therefore there is an economic value to such benefits and this value should be included in the benefits assessment.

- Adopt Reference Class Forecasting – As championed by Bent Flyvbjerg reference class forecasting more accurately estimates the cost than the traditional bottom-up estimates. This is because reference class forecasting is based on actual costs of comparable projects, which considers the cost of things not going to plan.

- Expand the Scope of Sensitivity Analysis – Following on from reference class forecasting sensitivity analyses should look not only at Everything According to Plan (bottom-up estimate), Most Likely Scenario (reference class estimate) but also the Worst-Case Scenario (every risk being realised). Using reference class data will allow project planners to see how often the Worst-Case Scenario comes to fruition. An assessment can then be made on whether the project is viable under the Most Likely Scenario, and whether the risk probability of the Worst-Case Scenario occurring is palatable to the public.

Conclusion

The complexities and intricacies of mega infrastructure projects can often lead to significant cost overruns and delays. With vested interests at play, it is crucial for there to be transparency and openness in planning, executing, and managing these projects. The efficient use of public funds is a responsibility shared by everyone involved in these projects.

To ensure meet we meet the expectations of the public, we need to employ robust frameworks for determining value for money, improve our methods of pricing intangible benefits, adopt reference class forecasting techniques, and expand the scope of our sensitivity analyses.

As we move forward, let’s remember that these aren’t merely projects. They are investments in our future, the future of our cities, and the legacy we leave behind for generations to come.

If you found this blog post insightful and wish to stay updated on the latest trends, news, and discussions in the world of infrastructure consulting, we invite you to sign up for our newsletter.

Recommended Readings

How Big Things Get Done – Bent Flyvbjerg and Dan Gardner

Infrastructure NSW – Final Business Case Evaluation Summary – Sydney Metro West

Infrastructure NSW – Final Business Case Evaluation Summary – Sydney Metro Western Sydney Airport

Sydney Metro City & Southwest Final Business Case Summary

Sydney Morning Herald – Sydney’s flagship harbour metro rail line billions over budget